The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by: TechFlow

“Recently, I’ve been chatting with some industry peers, and it seems like the crypto VCs from this cycle are pretty much done for. Fortunately, we didn’t invest heavily in the primary market but shifted our focus to secondary.”

“When talking with market makers, they expressed sympathy for us VCs. In the first year after a project launches, VCs don’t even get tokens. Only market makers, the project team, and exchanges have them. But when the price tanks, VCs take the hit and get mocked for holding 'VC tokens.'”

At a crypto event in Hong Kong, Yi Lihua, founder of LD Capital, spoke out in defense of crypto VCs. He believes they’re the biggest scapegoats of this crypto cycle, not only losing money but also facing criticism and ridicule.

As we head into 2024, many seasoned crypto VCs are leaving their roles to join project teams or focus on the secondary market. The reason is simple: they're not making money.

Currently, crypto VCs face multiple challenges: finding suitable investments is difficult, promising projects have sky-high valuations, and exiting old investments is tough. The altcoin secondary market is struggling with liquidity, and some projects see paper losses of 50%-90% right after launch. Even if VCs are fortunate enough to invest in good projects, extended token lock-up periods of several years make the future uncertain.

Many VCs rely on external LP funding and need to maintain a positive image. Even when things are rough, they have to act like everything is fine.

When project teams can’t get liquidity from the secondary market, it’s VCs who end up providing it.

This wave of crypto VCs is now fighting to protect their interests.

“Do you know what despair feels like? It’s the day ZKX launched,” said investor David, reflecting on his involvement in the project with a sense of regret.

ZKX Token, which had an initial investment cost of $1, crashed from an opening price of $0.60 to $0.20 on its first day of trading—an 80% loss right off the bat. And that wasn’t the end; ZKX kept dropping, eventually hitting a low of $0.000618, practically reaching zero.

Not long ago, ZKX was a promising star in the crypto space. As a leading derivatives platform on StarkNet, it had attracted $7.6 million in funding from top investors like GCR, Amber Group, Crypto.com, Hashkey, StarkWare, and OrangeDAO.

But on July 31st, ZKX’s founder, Eduard, stunned everyone by announcing the platform’s shutdown, citing an inability to find a sustainable economic path.

The news hit investors like a ton of bricks, leaving them shocked and unprepared.

Jin Kang, a partner at Perlone Capital, didn’t hold back his anger on X (formerly Twitter), calling ZKX a scam.

Kang pointed to several alarming issues: the team pulled the plug just six weeks after the TGE (Token Generation Event); they suddenly changed the token unlock schedule during the TGE; and the actual circulating supply far exceeded what was promised in official documents. "If this isn’t a scam, what is?" he questioned.

Rallying around Kang’s accusations, numerous ZKX investors have banded together to take action. The group, now 42 strong, is strategizing ways to fight back.

One investor, aware of the challenges within the current SAFT (Simple Agreement for Future Tokens) framework, suggested applying pressure on the StarkNet Foundation for compensation.

Amid these efforts, external teams have approached the investors, expressing interest in taking over and rebooting the ZKX platform, aiming to offer the existing community new trading opportunities.

ZKX is just one of many cases where VCs are fighting back. An investor revealed to TechFlow that they’ve paused new investments to focus on "post-investment management," closely monitoring the progress of projects they’ve already backed. For projects that have stalled, they’re actively seeking ways to recover their investments. Many of these are older projects from 2022, including some backed by major players like Coinbase Ventures, which once thrived on the metaverse hype but have since lost traction, with their social media channels now eerily quiet.

But reclaiming their money isn’t going to be easy...

Fighting for your rights in the crypto space can feel like an impossible task.

Yi Lihua, with years of experience in navigating crypto disputes, acknowledges that success stories in this realm are few and far between. Despite being involved in several cases, he’s seen little in the way of victory.

In the primary market, investors often have to accept the risk of loss, especially in crypto, where investments are typically made through SAFT (Simple Agreement for Future Tokens) or SAFE (Simple Agreement for Future Equity) contracts. These deals usually involve offshore entities like those in the British Virgin Islands, which come with legal complexities. The global and decentralized nature of these investments makes pursuing legal action particularly difficult.

For venture capitalists, taking legal action is usually a collective effort, requiring investors to band together and put pressure on project teams, often by appealing to their sense of fairness. However, the power still rests with the project teams.

Yi Lihua notes that in most cases, project founders either ignore these efforts or, at best, offer a partial refund, which is often considered a decent outcome.

A partner from a VC firm involved in the ZKX case admits that, despite the shared need for action, the differing interests and motivations of various investors make unified efforts challenging. Some VCs don’t have enough skin in the game to justify a full-blown legal battle.

Moreover, many VCs want to maintain their reputation and are reluctant to openly confront project teams unless absolutely necessary.

Interestingly, it’s often the individual investors—those unburdened by concerns over reputation—who are more successful in these disputes. In the crypto world, what begins as a matter of right and wrong often turns into a test of who can be more persistent and less concerned with appearances.

And it’s not just VCs who are seeking justice; many crypto influencers (KOLs) are also joining the fight.

For example, ALEX, a crypto industry figure, once teamed up with several KOLs to invest in a project during its KOL round. When ALEX approached the project team to request a refund, threatening to rally a FUD (Fear, Uncertainty, Doubt) campaign if they didn’t comply, the project team surprisingly welcomed the idea. They saw the potential FUD as a way to gain attention and boost the project’s visibility.

As Tolstoy once said, "All happy families are alike; each unhappy family is unhappy in its own way."

In the crypto world, successful VCs tend to share similar stories, but struggling VCs each have their unique ways of losing money.

According to some VC professionals, problematic projects can be classified into three main categories:

The "Rug Pull" Group: These are projects like ZKX that crash immediately upon listing and then abruptly shut down operations, leaving investors in the lurch.

The 'Deliberate Slacker' Group: These projects treat listing as the endgame. After listing, they consciously adopt a 'why even bother' attitude, allowing their token prices to nosedive. Investors, who haven't even received their tokens yet, are left with over 90% paper losses.

When confronted, the project team typically hits investors with the classic 'bear market, bro, we're still building' line. Meanwhile, investors are left HODL-ing their tears, itching to defend their rights but realizing they've got no legit grounds to do so. It's peak crypto pain, no cap.

The "Zombie" Group: After securing funding, these projects go into long-term hibernation, surviving multiple bull and bear markets while remaining eerily quiet. It makes one wonder if they joined the crypto industry just to witness history.

Some of these projects may maintain social media updates to show they're still "alive," but in terms of narrative, operations, and technological development, they're zombie-like – although still breathing, they're no different from being dead.

Both traditional and crypto venture capital follow the 80/20 rule: most projects will fail, and the successful 20% are expected to cover the losses and generate profits.

However, in crypto, even when VCs back "good projects," the returns are far from guaranteed.

One VC partner shared their experience of investing in a promising gaming project during the seed round. Despite its strong initial performance, the project team demanded last-minute contract changes before the token launch, extending the lock-up period, supposedly to meet exchange requirements.

Despite showing paper gains, the token has since dropped over 80% from its peak, leaving the partner to question the long-term viability of their investment. The partner expressed frustration, noting that crypto lock-ups now seem stricter than those in traditional stock markets.

In July, LD Capital partner Li Xi remarked, "All of LD Capital’s portfolio projects that have gone public this year are technically profitable, but it’s all paper value—zero tokens unlocked. Stop saying VCs are making money. The profits are all going to project teams and exchanges. Most VCs are just big bag holders. The primary market in this cycle is like hell mode."

Project teams aren’t just changing lock-up conditions; some are raising the cost basis for VC investments or buying back tokens mid-term—often at a discount, leaving VCs at a disadvantage.

Many VCs now feel like they’re the real underdogs in the industry. In the ongoing power struggle between project teams, VCs, exchanges, and retail investors, VCs often find themselves without leverage, forced to compromise.

For retail investors, "VC tokens" has become a derogatory term. Investor attitudes towards VCs have shifted from following to disillusionment, and even aversion.

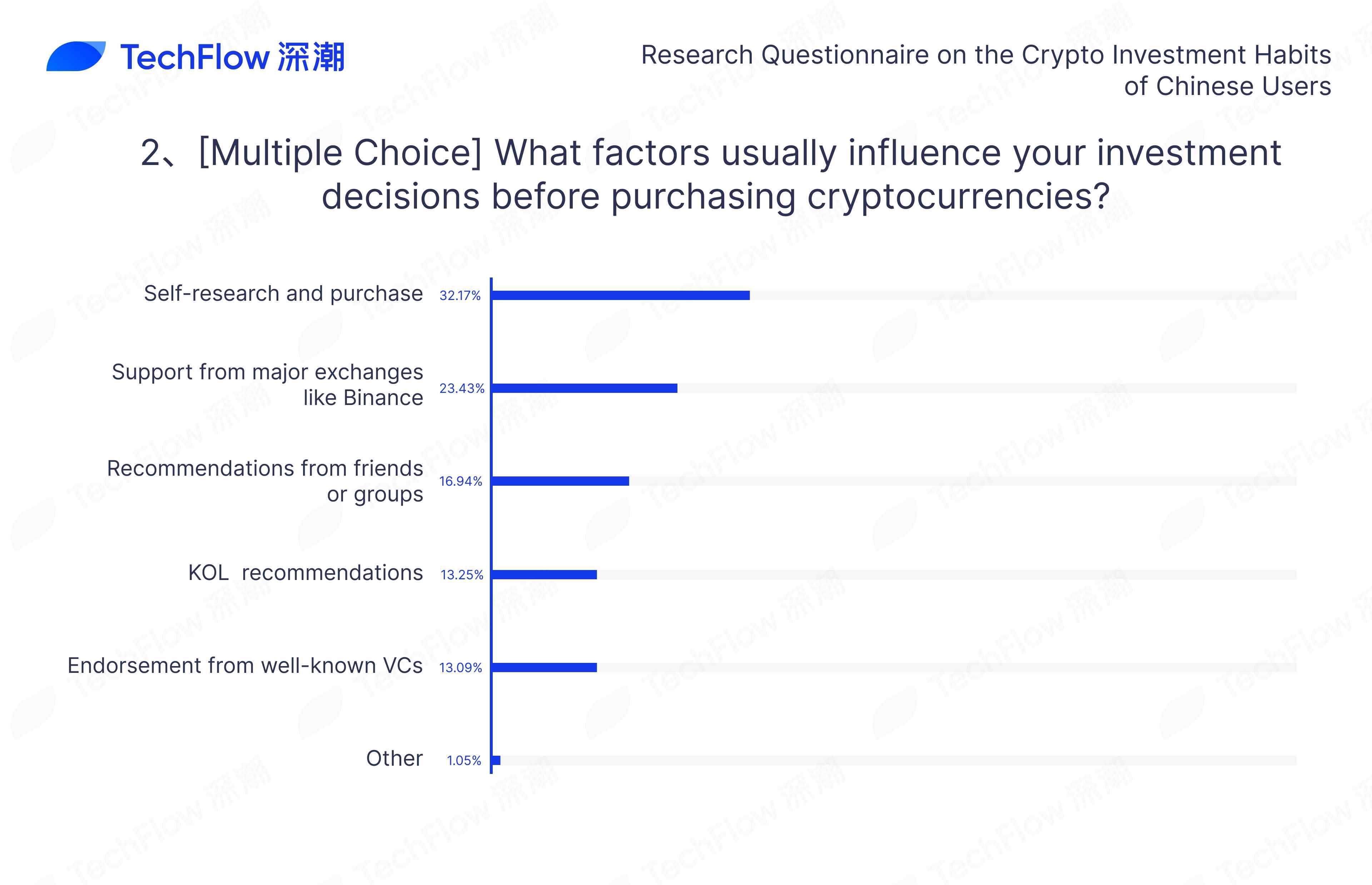

According to a recent survey by TechFlow, the influence of "well-known VC backing" in investment decisions was only 31%, even lower than KOL (Key Opinion Leader) recommendations.

Many VCs lack a distinct value proposition and often shy away from making independent decisions. They’re reluctant to lead rounds, instead asking questions like, "Which other institutions have invested in you? If XYZ has invested, we’ll consider joining."

This year, as the primary market has become increasingly challenging, several crypto VCs are pivoting their strategies. Some are diving deeper into project incubation, trying to increase their influence and become key players. Others are shifting away from the primary market entirely, focusing more on the secondary market.

But all this frustration might stem from one core issue: the market isn’t performing well. A strong bull run could easily smooth over most of these problems.

What the market really needs is an "altcoin season" to save the VCs who are stuck in tough positions.

It would be great if it comes, but what if it doesn't?

In the rapidly changing crypto market, it's not just project teams that need to actively adapt – perhaps crypto VCs need to change as well.

Recommendation

When Blast Starts Calling Itself a Full Stack Chain Instead of an L2, “Ethereum Alignment” Gradually Becomes a Meme...

Jul 07, 2024 14:23

Korean

Korean Crypto Market Observations: The Great Liquidity Exit Feast

Oct 10, 2024 15:37

Russia,Bitcoin

From Rubles to Bitcoins: Russias Pivot to Crypto in the Face of Sanctions

Oct 10, 2024 15:33