The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

Recently, you might have seen quite a bit about this character — a long-haired, bearded guy with glasses, radiating rock-star vibes.

His name is Murad Mahmudov. While he wasn't exactly a crypto influencer superstar before, the recent flood of global analysis and commentary about him online has suddenly catapulted him to the status of 'Meme Call King' and top hype man in the crypto world."

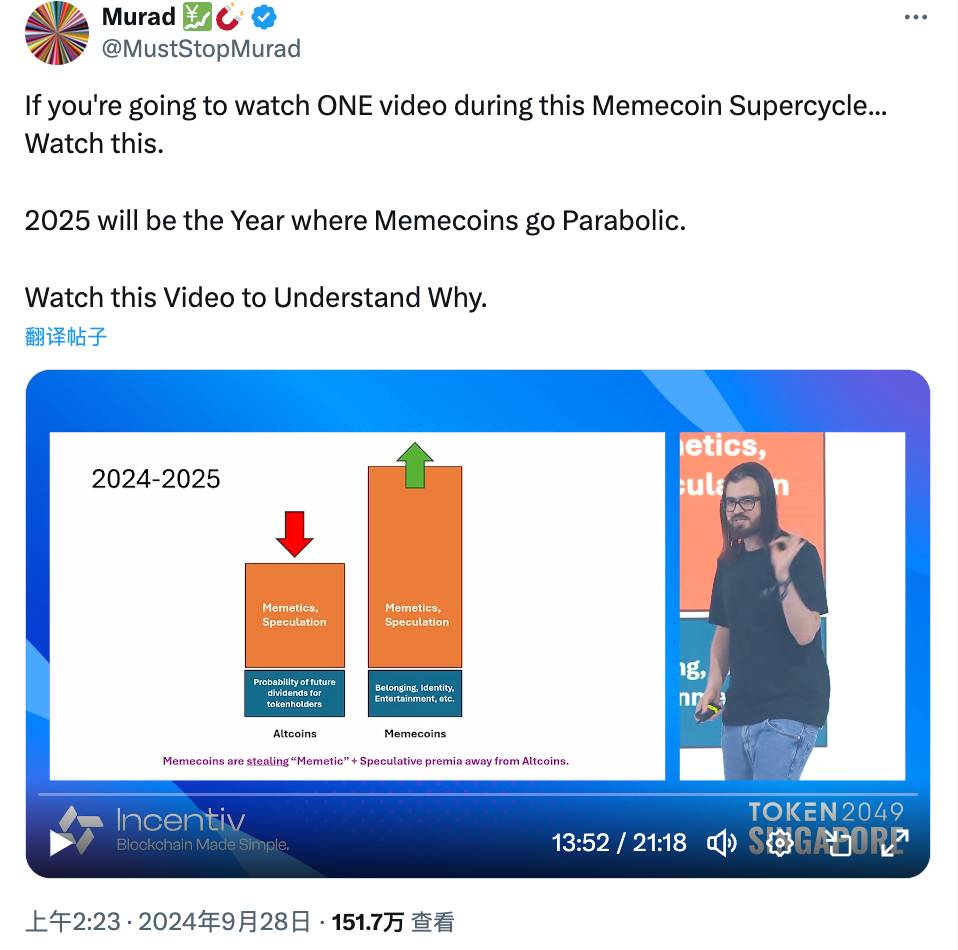

Murad shot to fame with his presentation at the Singapore 2049 Conference titled "The Meme Coin Supercycle," which, at the time of writing, has amassed 1.76 million views.

If you're not familiar with him, watching this video is a good start. You'll see him advocate for Meme coins with solid theories, comprehensive data, and an unmistakable conviction. His key statements are loaded with emotional appeal and are designed to startle and captivate:

For example, he predicts that the total market cap of Meme coins will exceed one trillion US dollars, that Bitcoin will reach 200 trillion US dollars within 20 years, and that investors need to completely rethink their strategies to embrace this new cycle of Meme coins...

Though many have tuned into his presentation, relatively little is known about Murad Mahmudov’s background:

From learning Chinese to his initial dive into the crypto world, from starting a hedge fund that eventually went bankrupt to becoming a master of Meme coin promotion, and his controversies, including when his wallet address was revealed sparking accusations of “talking his book”...

We’ve gathered more details to give you a quick overview of the journey of this new "call king."

Originally, Murad wasn’t a part of the crypto community.

He grew up in Azerbaijan and moved to the United States at age 16 for his studies, eventually attending Princeton University—a story similar to many young people who come to the U.S. with dreams of success.

Interestingly, according to an interview with Blockworks, it was during this period that Murad began learning Chinese and French.

His study of Chinese led to an opportunity to spend a year in China.

That year was 2013, when Murad was just 17 years old—and notably, it was the year Bitcoin saw its largest annual surge to date, increasing nearly 6000%.

At the same time, those who have been in the crypto space for a while will remember that back in 2013, China was undoubtedly the epicenter of the cryptocurrency world. The country's growing interest in mining and Bitcoin was noticeable, and Murad, finding himself in the midst of this burgeoning environment, described his experience in an interview as:

“I found myself in the right place at the right time.”

While in Beijing’s expat circles, Murad befriended employee number five from OKcoin, an American, who introduced him to the world of cryptocurrencies.

OKcoin later evolved into what is now known as OKX.

Clearly, Murad had an early brush with the crypto scene; his mention of the “right time” subtly refers to before the historic 2017 crash, known as the "September 4th" event, which saw a major market downturn. By then, he had already familiarized himself with crypto in China, an experience that significantly shaped his future views and career.

Afterward, Murad joined Goldman Sachs as a consultant, but his early exposure to Bitcoin significantly deepened his appreciation for it as a store of value.

Remember, at that time, memes were not yet a dominant force, and the old consensus of "Bitcoin as gold, Litecoin as silver" was still intact.

Thus, initially, Murad was more aligned with Bitcoin traditionalists rather than the Meme Cults.

2017 marked a turning point in Murad’s life.

Despite the crypto world reeling from the tumultuous "September 4th" crash, Murad founded Adaptive Capital, a modestly scaled crypto hedge fund.

Promotional materials for the firm still exist online; Murad's role there involved handling investments and trades, a position akin to what one might call a “trader.”

Being on the front lines, Murad certainly gathered considerable experience in trading and market observation.

However, there’s an old saying, "You can't walk by the river without getting your shoes wet," and this rings especially true in the unpredictable and turbulent world of cryptocurrency.

In 2020, as the COVID-19 pandemic swept across the globe, causing rapid shifts in international dynamics, the crypto market also faced intense volatility.

On March 13th of that year, as Bitcoin’s price plummeted by over $1000, Murad’s Adaptive Capital suffered a significant setback. The firm subsequently issued an open letter to all investors, announcing its closure and plans to return the remaining capital to its limited partners.

Adaptive Capital blamed its collapse on the fact that centralized exchanges (CEXs) halted services during the price crash, preventing them from managing their positions effectively, which led to liquidation:

"Some of the respected exchanges we use daily stopped operations during the selloff, severely hindering our ability to take appropriate actions."

In the colloquial terms of the crypto community, this is often described as exchanges “pulling the plug” on trading.

While it's hard to judge the rights and wrongs of the situation, as the head of trading and investments at the fund, Murad was clearly affected by the "plug-pulling" incident. This experience likely influenced his later shift towards blockchain-based Meme coins, seeking more opportunities on the blockchain.

In 2022, Murad became more active on social media, declaring, “I’m back.”

He is adamant that the industry will continue to attract more capital and believes that bear markets are the best time to plan for the next bull run.

Around the same time, various meme coins began to emerge, catching Murad's attention.

Everyone knows what came next: the long-haired guy took the stage at the 2049 conference and delivered his fiery speech titled "Memecoin Supercycle," sparking intense viewership and discussions across Crypto Twitter (CT).

Before this moment, Murad's story was relatively unknown. But there's a saying, "Those who tap into people's emotions are bound to attract attention," and Murad's remarks during his presentation brought him an unusual level of popularity. For example, he predicted that meme coins would reach a market cap of one trillion dollars and that Bitcoin's price could skyrocket to 200 trillion dollars within the next 20 years.

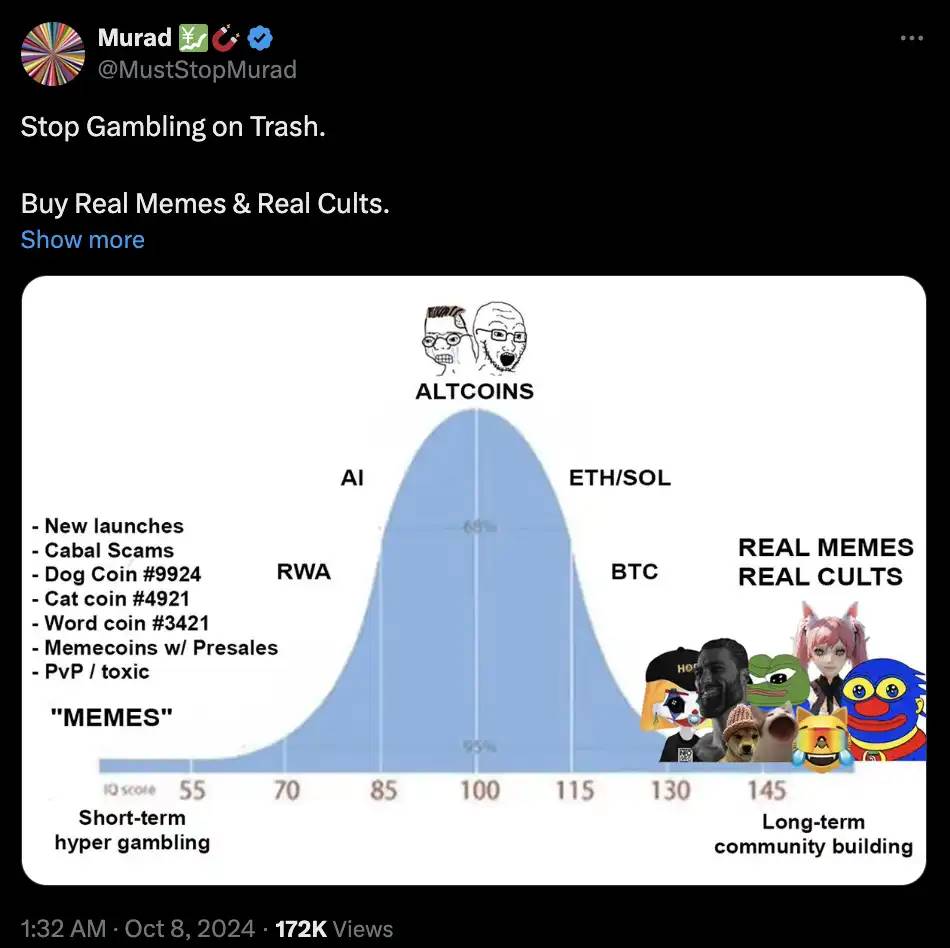

In a period dominated by meme coins, consistently breaking into the top 50 in market cap, Murad's "Supercycle" speech provided both legitimacy and justification for every meme coin investor’s portfolio. His approach extended beyond mere hype.

For instance, he described most cryptocurrencies with a blend of academic rigor and accessible language—if a token isn’t a store of value or doesn’t distribute income, it’s essentially a Memecoin.

Twitter user @0xWendy99 put it this way:

“This Princeton guy is different because his 'orthodoxy' has much more substance than Ansem’s; he speaks with the authority of a formal army. 'Tokenized communities,' 'tokens as products'—he’s not just rebranding memes as trivial or fringe elements, but elevating them with theory and system-driven speculation, making it sound sophisticated to retail investors and reasonable to institutions.”

Murad’s extensive trading background, combined with his strong theoretical understanding of market dynamics, made him a prominent figure during the supercycle.

However, fame often invites controversy.

As Murad’s popularity soared, he frequently made calls on various memes, assessing their quality and investment potential.

This activity led to suspicions about whether his fervent advocacy for memes was driven by self-interest or promotional motives.

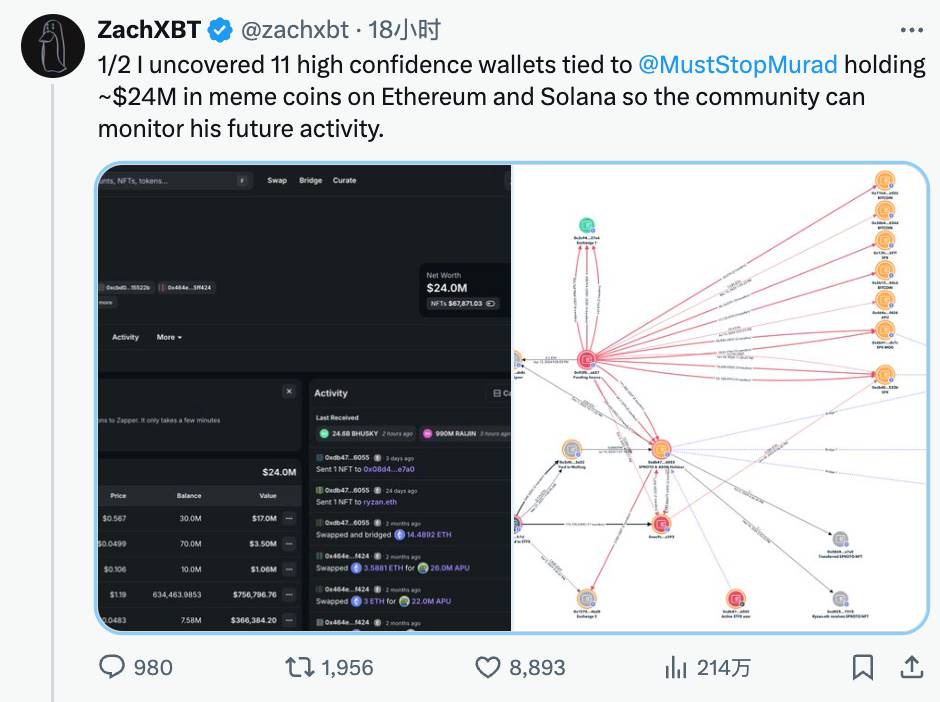

Blockchain detective ZachXBT got involved too, recently revealing 11 wallet addresses allegedly closely linked to Murad. These wallets collectively hold about $24 million worth of meme tokens on Ethereum and Solana, adding fuel to the speculative fire about his motivations.

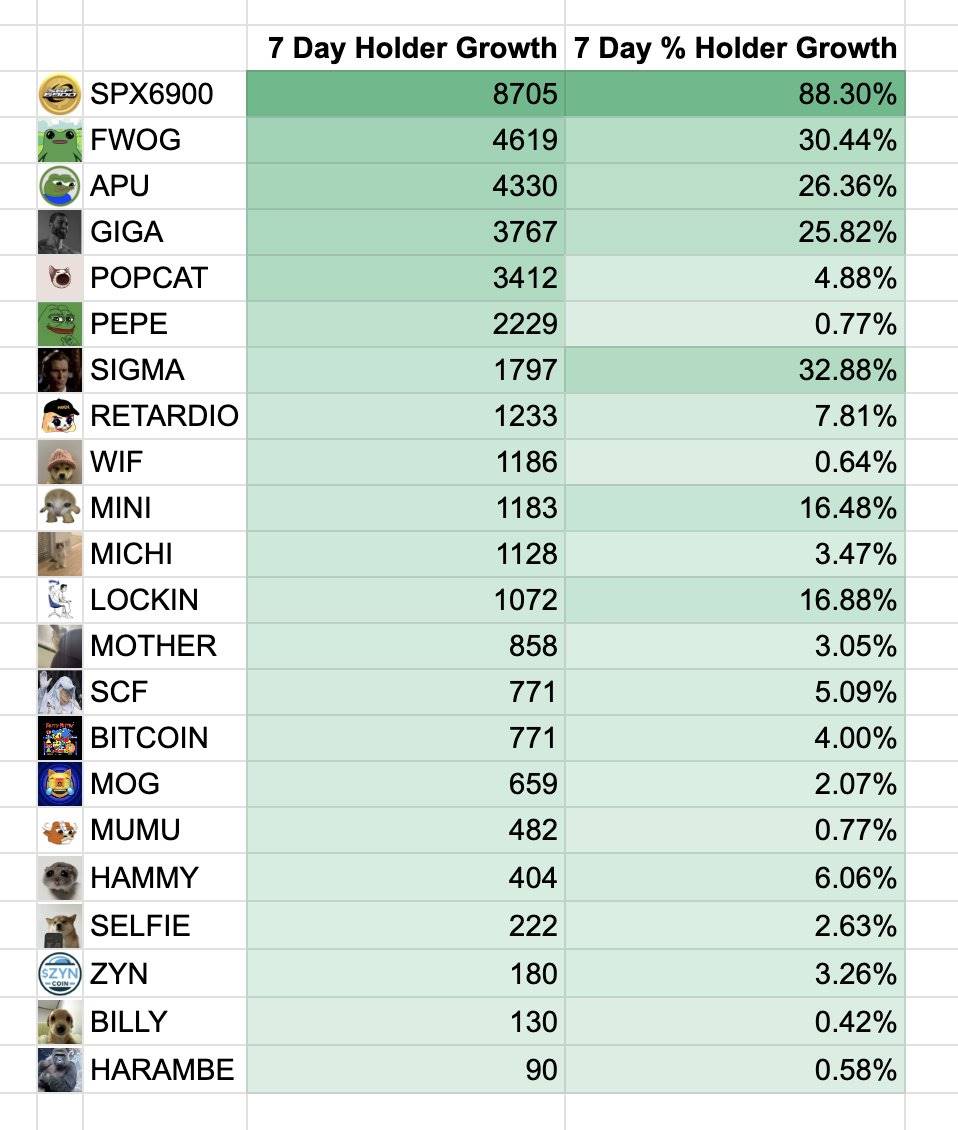

Data shows that some of the addresses bought substantial amounts of the meme coin SPX between June and August, achieving over 60x returns within four months. This coincided with the meme coins Murad had publicly recommended:

However, there’s a well-known saying in the crypto sphere:

Only foolish people invest in a coin and don't shill it.

Murad not only bought but also promoted, embodying the principle of practicing what he preaches. Whether this was a ploy to get others to buy in and pump his positions, or simply a genuine belief in the meme coin culture he wished to share, is up for interpretation.

The community is currently embroiled in a heated debate over the detective work that exposed Murad’s wallet addresses.

Some Twitter users think that ZachXBT’s efforts can prevent followers from being caught in a dump. The project lead of the Solana tool, Sol Incinerator, Slorg, queried, "Do you really think this stuff was hidden?" suggesting that the information was already public and, therefore, fair game to disclose.

Conversely, there are voices against exposing someone's complete financial dealings:

Udi Wertheimer, co-founder of Taproots Wizards, commented that revealing someone’s wallet to prevent potential misconduct is madness; some users also disagree with making Murad a target, especially when he hasn't committed any wrongdoing.

Buying and trading tokens isn’t inherently unruly;

But fame is a double-edged sword—when a staunch crypto bull suddenly garners massive attention and potential influence, people will inevitably scrutinize them, seeking to uncover more information. Whether for gaining more followers or in pursuit of justice against insider trading, fame naturally attracts controversy and complications.

It's unclear whether Murad is merely a dedicated bull or a manipulator of the masses, but he himself noted in an interview, "For some tokens, I definitely plan to sell some towards the end of 2025, early 2026... but for others, I intend to hold long-term to ride through the cycles."

There's a saying that rings true: the peak attracts fair-weather followers, while the twilight reveals the devout.

After a supercycle, whether Murad is left holding meme coins or BTC, only time will tell.

Attached: Blockchain detective's tweet with wallet addresses highly associated with Murad.

ETH

0x6b411100c72ba2445e50ffd20839c28b3546de7c

0xcbd0dee0c3eed152c3398b062361becc4a15522b

0x13fc38ec99a8217a06d1dc6db8c0bf0ee97ebf7f

0x71b4fd11eef705ba60176e7c034cd1a4f97ae02d

0x30b46a659761b576a00028b44d1e37fdc64b034d

0x5b1569db234a0f2884814a3f7184f01cf641b0c6

0x464e0a666734ba93e231d929ace538eaf05ff424

0xdb47714727cba70f0408ba30dc4ea0b5ac436055

SOL

7QZGS7MQ4S6hRmE8iXoFTXgQ2hXVUCho2ZhgeWvLNPZT

GyBkVYkHBPMapyQeueQ6d44YthwqYiX4ajgnGLqq9P7r

2xn57hPD2v6ighJFPXNPSoiGUXkW4KKo8Hb3NpXmHZvZ

Monitoring Dashboard:

https://dune.com/0xtoolman/murad-buys-and-sells

Recommendation

Liquid Restaking Token (LRT) Narrative Reignited: Seeking High-Potential Project Opportunities in the Endless Liquidity Loop

Jun 06, 2024 21:50

Understanding IMO: How Tokenizing AI Models is Crypto Worlds New Way to Embrace AI

Jun 06, 2024 19:09

Can $SEND in Solana Blink Match the Success of $DEGEN in Farcaster?

Jul 07, 2024 14:10