The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

"In the world of crypto, a day can feel like a year."

This saying captures not only the rapid fluctuations in asset prices but also the swift pace at which projects develop.

What can change in a project in just a few days?

Recently, Pyth Network, a top oracle project, quietly unveiled a countdown page on its website, accompanied by intriguing teaser text:

"Regain control, DeFi like never before."

On July 11th, coinciding with the EthCC conference, Pyth Network unveiled the mystery of their countdown—a new product called Express Relay, aimed directly at the pervasive and problematic issue of MEV (Miner Extractable Value) in the crypto 'dark forest.'

So, the "regain control" phrase actually refers to DeFi projects and users reclaiming the value that MEV has been siphoning away from them.

If you're involved in crypto as a practitioner or trader, you likely understand how MEV can inflate the costs associated with building projects and executing trades.

But why is an oracle project like Pyth tackling MEV?

Previously, Pyth's functionalities primarily supported the pre-launch phases of DeFi operations, such as providing price feeds. Targeting MEV suggests that Pyth is expanding its services to include more dynamic aspects of DeFi operations, like trading and settlement.

How does Express Relay technically improve not just the data sources for DeFi protocols but also the actual running of these operations?

With this venture into what seems like an "unconventional" business extension for an oracle provider, what are the odds of Pyth Network succeeding?

In this issue, let’s explore Express Relay in-depth to uncover answers to these questions.

To grasp the significance of Express Relay, we first need to understand the challenges faced by today’s DeFi projects.

A subtle but significant reality is that:

In the crypto dark forest, DeFi projects are particularly vulnerable, constantly preyed upon by MEV.

In this relentless hunt, both DeFi projects and their users end up bearing excessive costs.

Here, rather than diving deep into the technicalities of MEV, let's look at a common scenario in DeFi operations—liquidation—to make things clearer:

Liquidation Trigger: DeFi protocols, such as lending platforms, trigger a collateral liquidation process when a user's liabilities exceed their assets.

Searchers Take Action: Individuals known as Searchers, who specialize in identifying and executing liquidation opportunities, spring into action. They are driven by incentives offered by DeFi protocols, which usually come from fees or direct liquidation rewards, motivating them to carry out these operations.

Miners and MEV: Miners (or validators), who have the power to order transactions, often require Searchers to pay higher fees to prioritize their transactions, enabling miners to extract more value.

The Outcome: This leads to the MEV dilemma where the rewards intended for protocol users or Searchers mostly end up with the miners, skewing the intended distribution of benefits within the DeFi ecosystem.

This is akin to when you order takeout and the price ends up higher than the actual cost of the food. The platform and delivery service both take a cut, resulting in a higher final price for you.

For DeFi projects themselves, MEV introduces problems that often lead to "overpaying" for liquidation bonuses—essentially, making liquidations costlier:

Due to MEV slicing off a portion, lending protocols must offer substantial rewards to attract searchers to ensure timely liquidations. These substantial liquidation rewards mean that more funds are spent on these payouts, rather than enhancing other aspects of the protocol’s efficiency and profitability.

Public data indicates that Ethereum-based platforms like Aave and Compound have historically liquidated nearly $2.5 billion in collateral, of which $2.35 billion was the actual debt. This means that $150 million became rewards provided by these projects to liquidators, most of which went to miners.

A liquidation bonus of 4-5% seems overly generous compared to typical order depths.

When liquidation rewards are overpaid, these additional costs may eventually be passed on to users through higher interest rates or other fees.

Beyond the issue of cost, another significant challenge is finding reliable liquidators for emerging DeFi protocols.

Liquidation is decentralized across various protocols, each with different interfaces, leading to a shortage of available liquidators.

Therefore, many potential searchers may be reluctant to take on the role of liquidator. This can result in low availability of protocols and a lack of diversity among searchers.

For new DeFi protocols, setting up a reliable and cost-effective liquidation network is time-consuming and expensive. Developers must spend significant time and resources convincing searchers to integrate their protocols and cope with MEV.

In conclusion, in the often opaque environment of the crypto "dark forest," there is a consistent absence of a unified, transparent, and user-friendly industry standard in operations like liquidations or other DeFi activities:

Redirecting the value that MEV takes from miners back to DeFi protocols, users, and searchers;

Connecting DeFi protocols with a network of high-quality searchers for reliable liquidation.

This is the driving force behind the launch of Pyth Express Relay.

Oracles are not just oracles.

Backed by Douro Labs, which has experience in developing low-latency oracle protocols for blockchain, Pyth Network has been developing a solution to make DeFi liquidations more cost-effective and to minimize the impact of MEV.

This solution is what we now know as Pyth Express Relay (ER).

To quickly understand what ER can achieve, consider this simple explanation:

MEV isn't unavoidable, and with ER, everyone can come out ahead.

To outline the benefits of using Pyth Express Relay (PER) for different participants, here’s the TL;DR version:

Protocols and users can more effectively reclaim the value that used to be captured by miners/validators.

Developers can deploy applications more quickly.

Searchers find it easier to get involved in operations like liquidation, benefiting both the ecosystem and themselves.

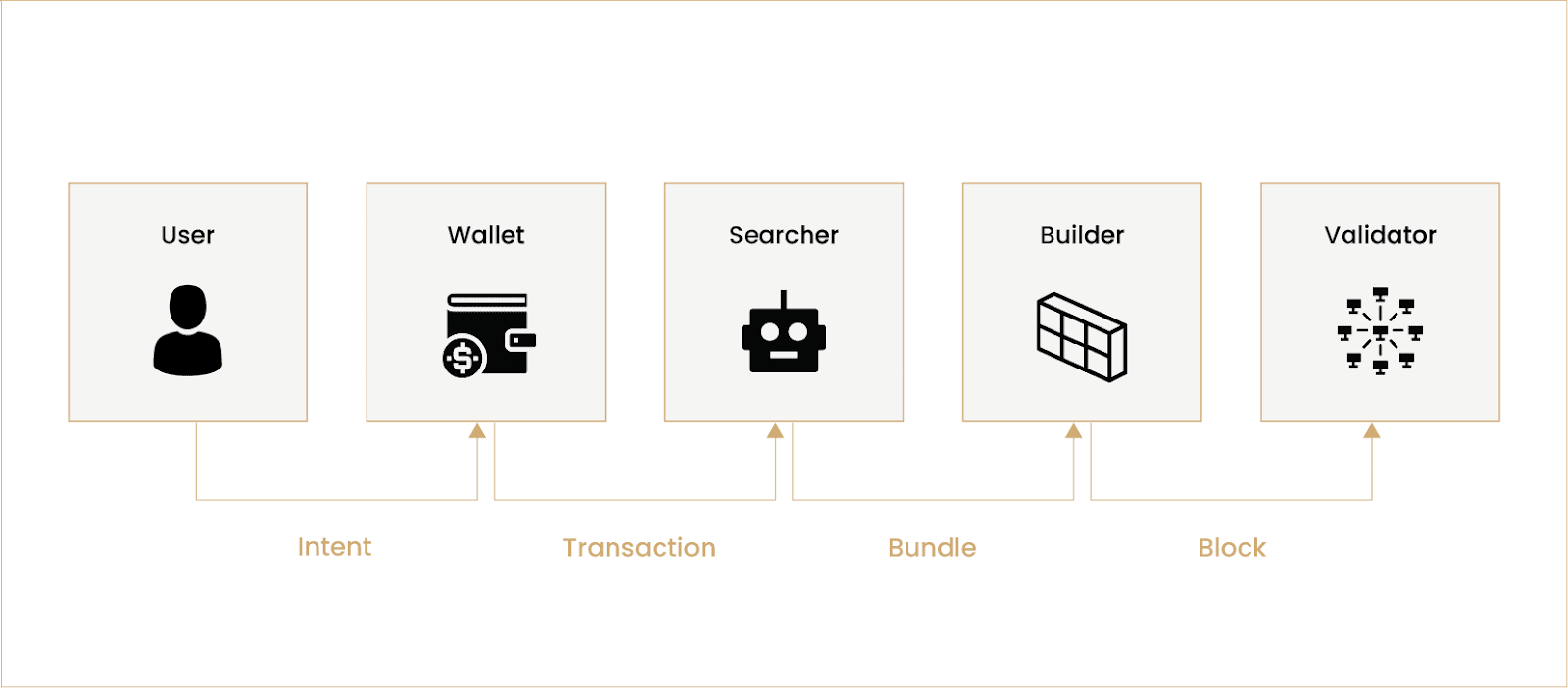

Diving into the details of how PER works, its design philosophy centers on isolating off-chain order flow auctions to separate certain transactions and minimize the space for miners to extract MEV.

You can think of it like this: Express Relay connects DeFi protocols directly to a bespoke network of searchers and allows these searchers to bid for priority when submitting transactions. These transactions are then ordered in an independent auction not controlled by miners, thus eliminating the possibility for miners to siphon off MEV value.

Essentially, before transactions ever get to miners for sorting, they’ve already been filtered, sorted, optimized, and packaged; by the time they reach the miners, their value is already clearly determined and secured.

By allowing DeFi protocols to auction off the priority of these key operations, Express Relay ensures that searchers can more actively compete for the value of transactions. A direct advantage is that DeFi protocols can more efficiently allocate funds towards setting up liquidation rewards and other initiatives, and pass these savings onto protocol users and other stakeholders.

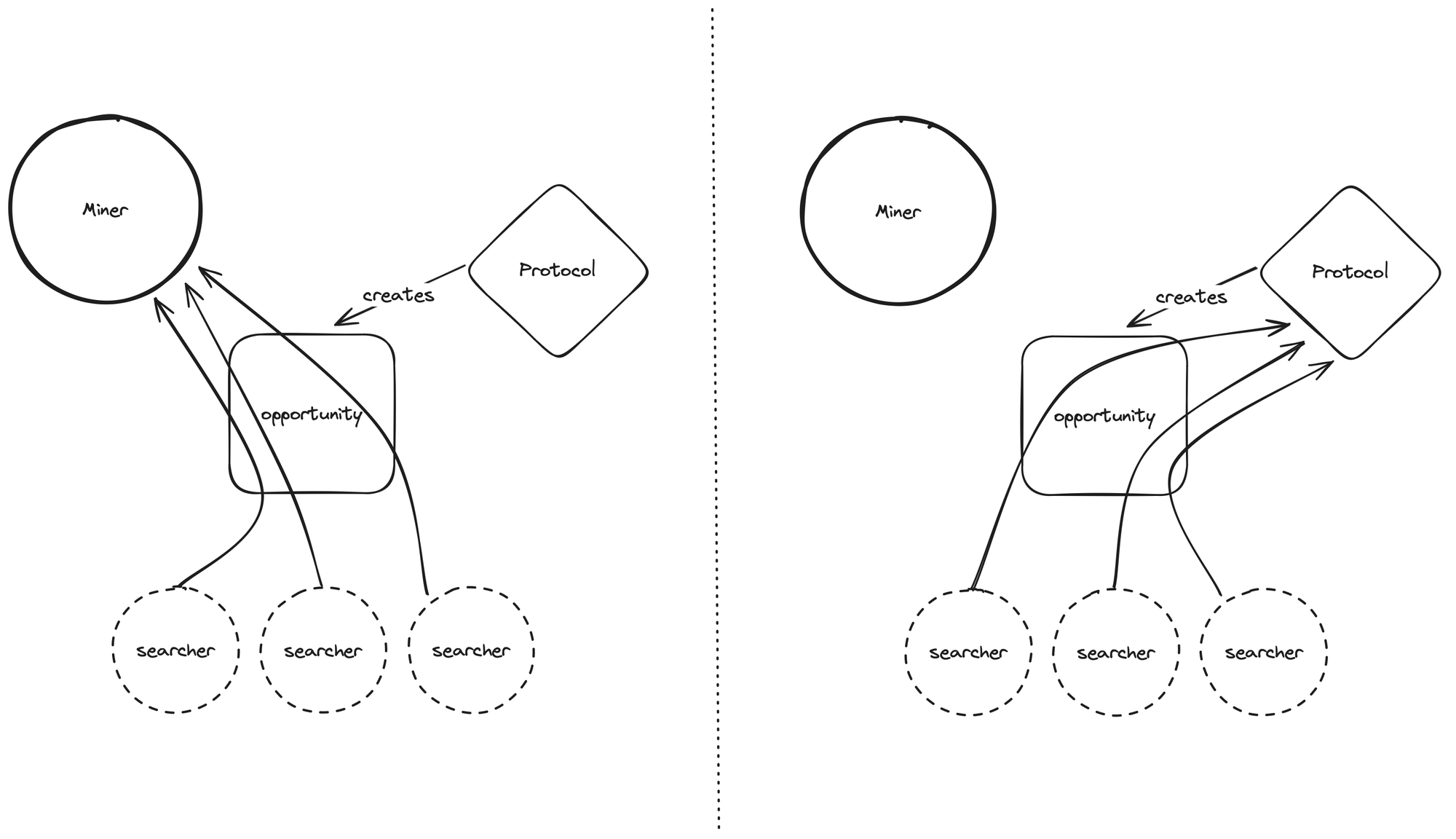

If it's still a bit unclear, let's simplify it further. Imagine a diagram that strips away all the technical jargon to show you clearly the difference between using Express Relay and not using it:

On the left side, you'd see the traditional transaction workflow where the value generated by protocols ends up leaking to blockchain miners. In contrast, Express Relay blocks miners from extracting value from searchers who are scouting for opportunities, allowing DeFi protocols instead to retain most of that value.

Put simply, the value from transactions no longer flows to the miners.

To further understand how Express Relay safeguards value, let's walk through a practical workflow:

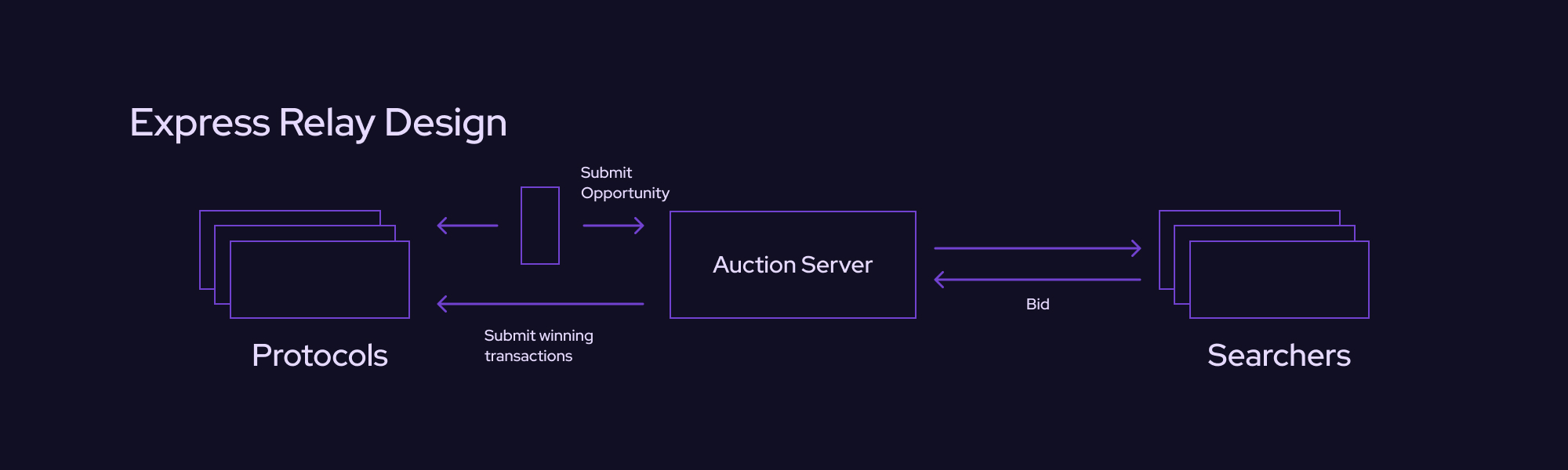

Key Players:

Protocol (DeFi Protocol): Submits opportunities for transactions, such as potential arbitrage or liquidation openings, to the auction server.

Auction Server: Receives these opportunities from the protocol and presents them to searchers, who bid on these opportunities. The server selects the highest bidder and returns the winning transaction to the protocol.

Searchers: Receive transaction opportunities from the auction server, bid on them, and if successful, submit their transactions back to the auction server, which then forwards them to the protocol.

Step-by-Step Breakdown:

Opportunity Submission: Protocols discover certain transaction opportunities and send these to the auction server.

Bidding Process: The auction server showcases these opportunities to all searchers. The searchers analyze these opportunities and submit their bids.

Winner Selection: The auction server selects the searcher who offers the highest bid. The successful bidder then submits their transaction to the auction server.

Transaction Submission: The auction server submits the winning transaction back to the protocol, which then packages and submits it to the blockchain network.

This isolated off-chain priority auction system securely connects DeFi protocols directly to searchers, enhancing transaction efficiency by auctioning off the priority of key operations. Express Relay effectively removes miners/validators from the MEV supply chain, empowering protocols to manage their own transaction priorities and regain control.

Express Relay appears to solve the first issue we discussed: the high cost of liquidation for DeFi protocols.

For emerging DeFi protocols struggling to find reliable liquidators, Express Relay offers a "plug-and-play" solution. Without it, developers would need to build their own liquidation networks and persuade searchers to integrate with their protocols. With Express Relay, new protocols can effortlessly connect to an established network of elite searchers to initiate their liquidation processes.

Protocols can bypass the traditional contract-signing process and simply deploy the Pyth Express Relay contract to quickly establish their own liquidation network.

For searchers, Express Relay consolidates liquidation and other valuable transaction opportunities from various DeFi protocols into one location. This allows searchers to vie for all these opportunities without writing custom code for each protocol’s interface. By lowering integration costs, Express Relay enables searchers to operate more efficiently and resolves the dilemma of sourcing liquidators.

You might wonder, with protocols benefiting from this setup but miners/validators losing out on MEV revenue, what if they opt out?

If an increasing number of DeFi protocols and searchers adopt Express Relay, this technology could evolve into an industry standard. As adoption spreads, miners will need to adapt to this new transaction model because most high-value transactions will likely be handled through Express Relay or similar technologies.

Furthermore, given Pyth Network's history of building strong partnerships in the oracle space, Express Relay could work with multiple large DeFi protocols to form a coalition that promotes this technology, boosting its adoption and impact.

After all, who doesn't appreciate a solution that's ready-to-use and beneficial?

While Pyth Network is traditionally tied to oracles, venturing into MEV might seem like a departure. However, the situation is quite the opposite.

The strong alliances previously mentioned are already benefiting Express Relay. The existing oracle business has effectively laid a broad network that bridges supply and demand sides, creating significant migratory network effects.

From the supply side, the searcher network constructed by Express Relay includes top-tier market makers who had previously collaborated with Pyth and are now confirmed to act as searchers in the new product.

Officially, market makers such as Wintermute, Flow Traders, Flowdesk, Auros, Caladan, Tokka Labs, and Swaap Finance have quickly become searchers assisting DeFi protocols with their liquidation needs.

This means that Pyth’s Express Relay doesn't have to worry much about the cold start problem, thanks to several top market makers who naturally "come with resources," forming the front line of this newly built network of searchers.

This provides an unmatched advantage for a new project tackling MEV-related challenges.

On the demand side, many projects already serviced by Pyth’s oracle operations are in areas like lending and perpetual swaps within the DeFi sector, which not only require data feeds but also support from a liquidation network.

Why not embrace a solution where both needs are addressed by different products from the same provider, Pyth?

This is akin to monetizing web traffic in the Web2 world, where existing user bases are leveraged to expand into additional services. For Pyth, its previous oracle operations have already established a well-founded, extensive, and closely integrated business base.

With over 100 data publishers, 500+ price feeds, 300+ integrated dApps, and support for 60+ blockchains, the shovel-ready effect is clearly at play not just in token airdrops but also in business expansion and transition, facilitating smooth progress.

In the entertainment industry, it’s common for talented actors to branch into singing.

Similarly, as Pyth Network strengthens its business capabilities and different operations become interlinked, it is evolving into a versatile entity, moving from oracles to MEV, solving multiple backstage issues that are critical to projects but not always apparent to users.

When a project becomes a master orchestrator in the crypto world, enabling DeFi protocols to access more efficient and cost-effective services, the backstage efforts become streamlined. This, in turn, enhances the space for front-end performers (protocols) to excel, and naturally improves the audience's (users’) experience.

A better Web3 doesn’t depend solely on the heroics of individual projects, but the efforts of those behind the scenes are also worthy of attention.

For more information about Pyth Express Relay, visit the official website to explore further.

Recommendation

Exploring Kontos: Simplicity Redefined, a Single Gateway to Seamless Blockchain Integration

Jul 07, 2024 14:32

Unpacking Pi Squared: Academic Leaders from Elite Universities Spearhead a $12 Million Funding for a ZK Universal Settlement Layer

Jul 07, 2024 14:26

Morpho

The Transformation Journey of Morpho: From Lending Products to Infrastructure

Nov 11, 2024 15:37