The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

Infrastructure never sleeps, and the blockchain scene has more platforms than applications.

While the market suffers under the onslaught of high-profile project airdrops, the primary market is still avidly churning out the next big names.

Last night, another powerhouse L1 made its debut—MegaETH, launching with a $20 million seed funding round led by Dragonfly. Figment Capital, Robot Ventures, and Big Brain Holdings also joined the round, with angel investments from notables like Vitalik, Cobie, Joseph Lubin, Sreeram Kannan, and Kartik Talwar.

Top-tier venture capital firms leading the investment, crypto heavyweights like Vitalik as angel investors, and a project name that incorporates "ETH". In a crypto market where attention is limited, these labels all work to establish a certain legitimacy for the project.

From the official project description, MegaETH can be succinctly described in one familiar word: fast.

It's touted as the first real-time blockchain, promising lightning-fast transaction speeds, sub-millisecond latency, and the ability to process over 100,000 transactions per second...

At a time when the market is fatigued by the usual narratives about blockchain performance, what makes MegaETH stand out?

We've taken a deep dive into MegaETH's whitepaper to try to find the answer.

Setting aside narrative and hype, why does the market need another blockchain like MegaETH?

MegaETH itself provides the answer, pointing out that simply creating more chains doesn't address the scalability issues facing today's L1/L2 networks:

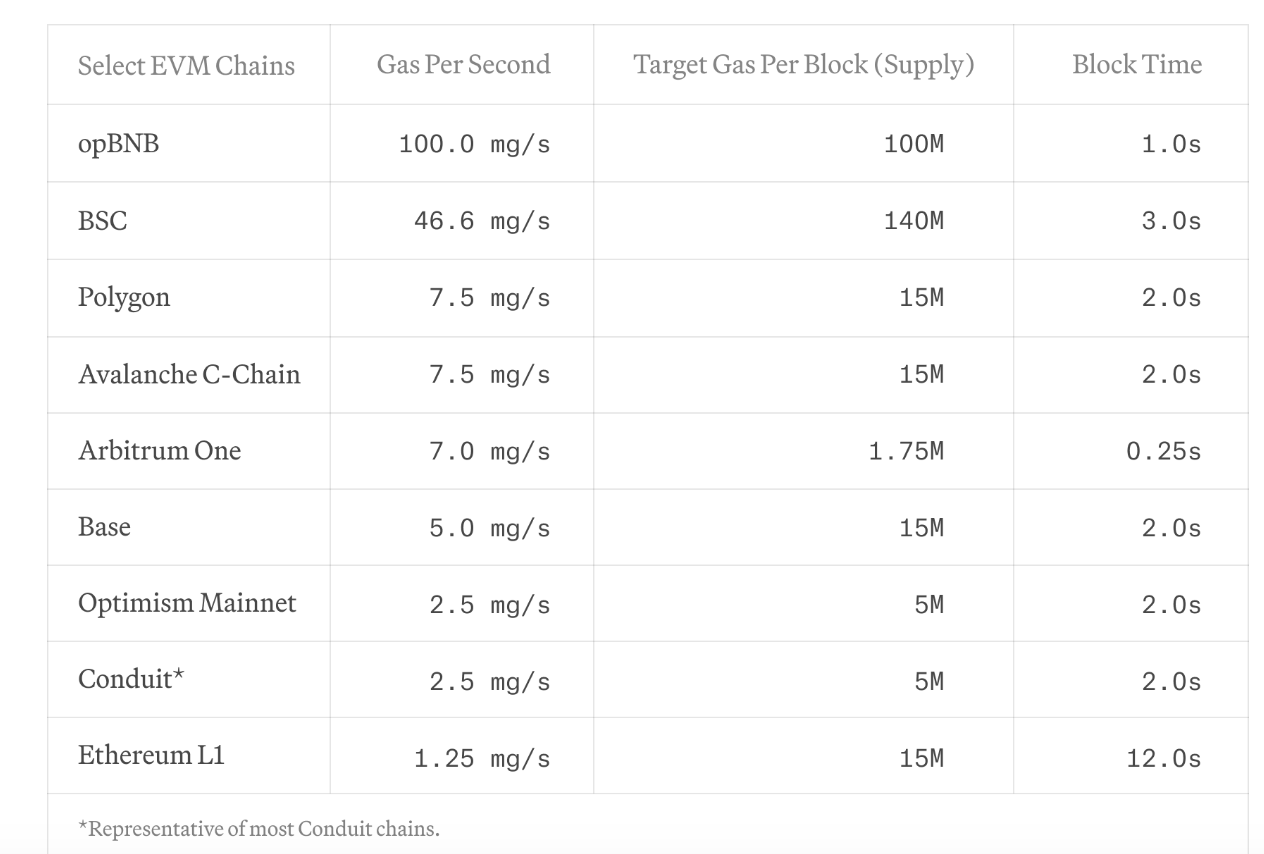

All EVM-compatible chains show relatively low transaction throughput;

Additionally, complex applications struggle to operate due to limited computational capacity;

Finally, applications that require high update rates or rapid feedback cycles are impractical given the long block times of existing chains.

In simpler terms, current blockchains just can't deliver:

Real-time settlement: Transactions are processed and the results published almost instantaneously as they hit blockchain.

Real-time processing: The blockchain system can handle and verify a massive volume of transactions in just moments.

What does this mean in practical terms?

Take high-frequency trading, where the ability to place and cancel orders within milliseconds is crucial. Or consider real-time combat or physical simulation games that demand the blockchain update its state extremely frequently. Clearly, existing chains fall short.

So, how does MegaETH plan to achieve this "real-time" capability? The nutshell version is:

Node Specialization: By separating the tasks of transaction execution from those of full nodes, it minimizes consensus overhead.

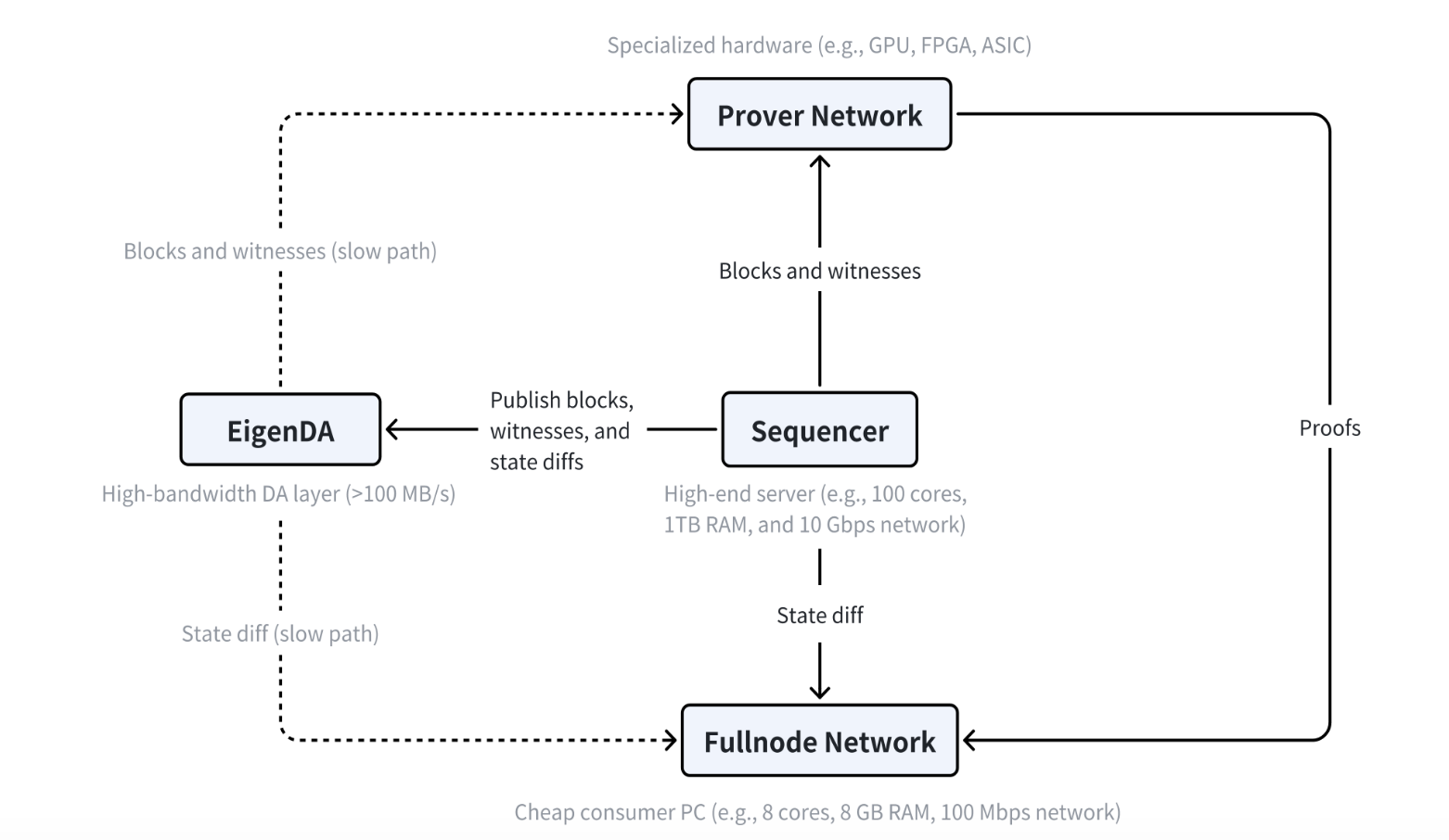

To break it down further, MegaETH involves three main roles: sequencers, provers, and full nodes.

Specifically, MegaETH operates with just one active sequencer at any given time to execute transactions, while other nodes receive state differences via a peer-to-peer network and update their local state without re-executing transactions.

The sequencer is tasked with ordering and executing user transactions. However, MegaETH limits itself to one active sequencer at any time, thereby cutting out the consensus overhead during normal operations.

Provers employ a stateless verification scheme to verify blocks asynchronously and in no particular order.

Here’s a simple breakdown of how MegaETH works:

Transaction Processing and Ordering: User-submitted transactions are first sent to the Sequencer, which processes these transactions in sequence, generating new blocks and witness data.

Data Publishing: The sequencer then publishes the new blocks, witness data, and state differences to EigenDA (Data Availability Layer), ensuring these data remain accessible across the network.

Block Verification: The Prover Network retrieves blocks and witness data from the sequencer, verifies them using specialized hardware, produces proofs, and sends them back to the sequencer.

State Update: The Full Node Network receives state differences from the sequencer, updates the local state, and can also validate the block's legitimacy via the Prover Network, maintaining the blockchain's consistency and security.

From additional insights in the whitepaper, it's apparent that MegaETH recognizes the promise of "node specialization." However, this concept isn’t as straightforward to implement as one might think.

MegaETH’s strategy for developing their blockchain involves a critical initial step: thorough performance measurements. They aim to pinpoint the real issues plaguing existing blockchain systems before applying the node specialization concept to solve these problems effectively.

So, what issues has MegaETH identified?

The next section delves into technical details that might not resonate with the casual investor, so feel free to skip ahead if you're short on patience.

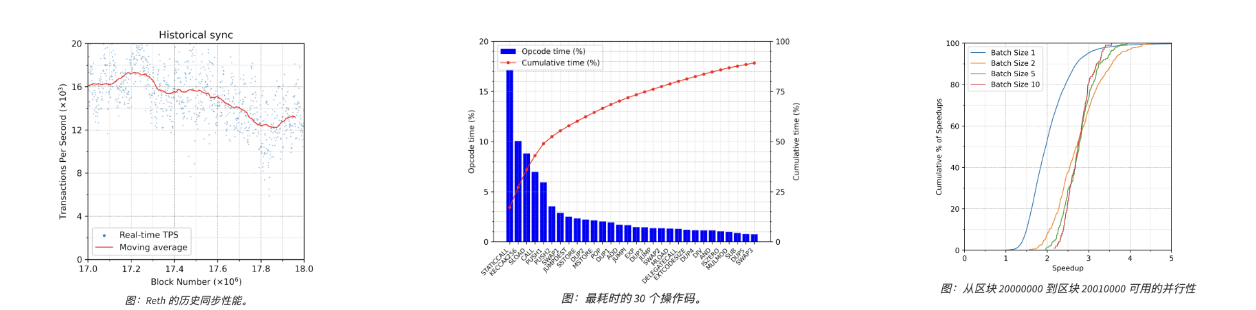

Transaction Execution: Their tests reveal that even servers with 512GB of memory can only push the current Ethereum execution client, Reth, to about 1000 transactions per second (TPS) in real-time sync settings. This highlights a significant bottleneck in how transactions are executed and updated within the system.

Parallel Execution: The buzz around parallel EVMs suggests a solution to performance bottlenecks, but it comes with its own challenges. MegaETH’s findings indicate that the actual boost from parallel EVMs in production is limited by the workload’s ability to be parallelized. In recent Ethereum blocks, the median level of parallelism was found to be less than 2, increasing only slightly to 2.75 when multiple blocks are combined.

(This level of parallelism, being less than 2, suggests that in most cases, fewer than two transactions can be executed at the same time within each block. This reflects a system where transactions are mostly interdependent, thwarting efforts to scale up parallel processing significantly.)

Interpreter Overhead: Even faster EVM interpreters like revm are significantly slower than native execution, often by one to two orders of magnitude.

State Synchronization: Syncing 100,000 ERC-20 transfers per second requires 152.6 Mbps of bandwidth, and more complex transactions demand even more. Updating the state root in Reth is ten times more computationally intensive than executing transactions. Simply put, current blockchains consume a lot of resources.

After diagnosing these issues, MegaETH began crafting targeted solutions, which helps to make sense of the solution strategies outlined earlier:

High-Performance Sequencers:

Node Specialization: MegaETH increases efficiency by designating specific tasks to specialized nodes. Sequencers handle transaction ordering and execution, full nodes manage state updates and verification, and provers use specialized hardware for block verification.

High-End Hardware: Sequencers are equipped with high-performance servers, like those with 100 cores, 1TB of memory, and 10Gbps networks, enabling them to manage large transaction volumes and quickly generate new blocks.

Optimized State Access:

Memory Storage: Sequencers are loaded with ample RAM, allowing the entire blockchain state to be stored in memory, which eliminates delays from SSD reads and accelerates access to state data.

Parallel Execution: Despite the limited impact of parallel EVM in existing workloads, MegaETH has refined its parallel execution engine and introduced transaction priority management to ensure timely processing of critical transactions during peak times.

Interpreter Optimization:

AOT/JIT Compilation: MegaETH has integrated AOT/JIT compilation to speed up the execution of compute-heavy contracts. Although most contracts see limited performance boosts in production, these technologies significantly improve performance in scenarios requiring intense computation.

Optimized State Synchronization:

Efficient Data Transmission: MegaETH developed a method for efficiently encoding and transmitting state differences, allowing for extensive state updates even with limited bandwidth.

Compression Techniques: Advanced compression methods enable MegaETH to synchronize updates for complex transactions, like those in Uniswap swaps, within bandwidth constraints.

Optimized State Root Updates:

Optimized MPT Design: MegaETH employs an optimized Merkle Patricia Trie (such as NOMT), reducing read-write operations and enhancing the efficiency of state root updates.

Batch Processing: By batching state updates, MegaETH minimizes random disk I/O, boosting overall system performance.

While the details are technical, stepping back reveals that MegaETH not only has solid tech chops but also a clear intent:

By sharing detailed technical data and test results transparently, MegaETH aims to build its credibility and transparency, helping the technical community and potential users gain a deeper understanding and trust in the performance of their system.

As you parse through the whitepaper, it's evident that despite MegaETH’s somewhat flamboyant name, the documentation radiates the precision and depth typical of true tech nerds.

Public records indicate that MegaETH's team boasts a Chinese background. The CEO, Li Yilong, is a Stanford-educated PhD in Computer Science; the CTO, Yang Lei, earned his PhD from MIT; and the Chief Business Officer (CBO), Kong Shuyao, is an MBA graduate from Harvard Business School with experience at notable industry institutions like ConsenSys. Additionally, the advisors share some of Kong Shuyao's credentials and hail from another esteemed institution, New York University.

A team comprised entirely of alumni from top U.S. universities undeniably wields considerable influence in terms of connections and resources.

We previously discussed in the article "From Graduate to CEO: Nexus Secures $25 Million Led by Pantera - What's the Story?" that Nexus's CEO, although a recent graduate, hailed from Stanford and possessed a solid technical foundation.

It seems that top-tier VCs indeed have a preference for tech leaders from prestigious universities, especially when figures like Vitalik are involved and the project's name includes "ETH." This combination is likely to maximize both the technological narrative and marketing impact.

In a market where former titans are fading and projects struggle to gain momentum amid fluctuating conditions, MegaETH is set to spark a new round of FOMO.

We'll continue to monitor and report on developments related to the project's testnet and user interactions.

Welcome to the official TechFlow community!

Telegram subscription group: https://t.me/TechFlowDaily

Official Twitter account: https://x.com/TechFlowPost

English Twitter account: https://x.com/TechFlow_Intern

Recommendation

dappOS

The Ultimate Intent of Web3: How dappOSs Intent Assets are Unlocking True Asset Appreciation for You

Nov 11, 2024 15:52

Morpho

The Transformation Journey of Morpho: From Lending Products to Infrastructure

Nov 11, 2024 15:37

Understanding Bittensor (TAO): The Ambitious AI Lego Making Algorithms Modular

Jun 06, 2024 22:02